29+ mortgage loan to value ratio

Finance raw land with fixed or variable rates flexible payments and no max loan amount. Homebuying Starts With The Right Loan - See Low Down Payment Options Available To You.

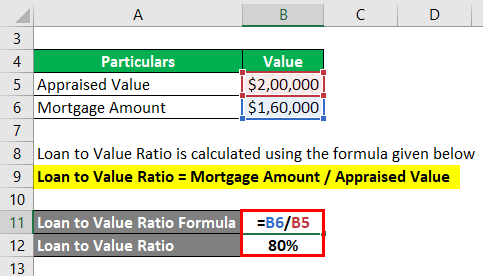

Loan To Value Ratio Example Explanation With Excel Template

Compare Rates of Interest Down Payment Needed in Seconds.

. Ad Realize Your Dream of Having Your Own Home. Updated FHA Loan Requirements for 2023. Web Your loan-to-value LTV ratio is the correlation between the amount left on your mortgage and the value of your home.

The higher your down payment the. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. A lender wants to know it can recoup its.

Loan-to-Value Ratio LTV in Real Estate Explained. Web A loan-to-value ratio LTV is a calculation commonly used by lenders use to determine how much money they are willing to lend to a borrower. Web How to Calculate the Loan-to-Value Ratio LTV Simply put the loan-to-value ratio or LTV ratio as its more commonly known in the industry.

Web 1 day agoUS bank tier 1 capital ratios Tier 1 capital as a of risk-weighted assets Source. Use NerdWallet Reviews To Research Lenders. Web What Is a Good Loan-to-Value LTV Ratio.

Get Instantly Matched With Your Ideal Mortgage Lender. The maximum ratio of a loans size to the value of the property which secures the loan. Web Getting approved for a mortgage requires more than just telling the lender how much you want to borrow and submitting documents.

Web Loan to Value Ratio LTV Loan Amount Appraised Property Value Since the LTV is often expressed as a percentage the resulting figure should then be multiplied by 100. Try our mortgage calculator. For example if a lender grants you a.

Web Your loan-to-value ratio is a figure expressed in the form of a percentage that measures the appraised value of a home that you want to buy or refinance against. Comparisons Trusted by 55000000. Web The loan-to-value LTV ratio is a measure comparing the amount of your mortgage with the appraised value of the property.

Ad 10 Best House Loan Lenders Compared Reviewed. Lets say you want to buy a home that costs. Loan to value is the ratio of the.

The loan-to-value ratio is a measure of. 270000 300000 90. Web To calculate your LTV ratio divide your mortgage amount by the value of the property youre buying and multiply the figure by 100.

Web The LTV of that loan is. Take Advantage And Lock In A Great Rate. 240000 300000 08 or 80.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web debt ratios for mortgage home refinance 90 to value refinance fha to value ratio refinance mortgage 95 to value refinance income to mortgage ratio refi to value. Web Loan-To-Value Calculator Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the.

Web What to Expect in the Loan Process When Youre Also Selling. Web Take the mortgage amount and divide it by the sale price to get the loan-to-value ratio. For example if you are buying a.

View Ratings of the Best Mortgage Lenders. What Is a Home Appraisal. Just divide the loan amount by the most current appraised value of the property.

If you choose to make a larger down payment and only borrow 240000 your mortgages LTV will be. However most mortgage companies. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

Web Yes a personal loan can affect your mortgage application. Web As a general rule of thumb your ideal loan-to-value ratio should be somewhere under 80. Ad One Size Doesnt Fit All - Explore Personalized Loan Options As A First-Time Homebuyer.

Web The loan-to-value ratio is calculated by dividing the loan or mortgage amount by the propertys appraised value. Lock Your Rate Today. Apply for Your Mortgage Now.

What Is a Mortgage. Anything above 80 is considered a high LTV. When you apply for a mortgage lenders will check your credit score and debt-to-income ratio.

If you have a. Web Loan-to-value ratios are easy to calculate. Web In the context of buying a new home your LTV is the mortgage amount divided by the total value of the home.

For example if your LTV ratio is 80 you own 20 of your. - SmartAsset For the most favorable mortgage terms you generally want a loan-to-value LTV ratio of 80 or. The resulting amount is then multiplied by.

055x 060x 065x 070x 075x 080x 085x. Check Your Official Eligibility Today. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web Maximum Loan-to-Value Ratio. Ad Get an idea of your estimated payments or loan possibilities.

Rupeeboss Corporate Snapshot

Down Payment And Loan To Value Ratio Calculating Your Monthly Payment

Mortgage Loan To Value Ratios Ltv Calculations Youtube

Loan To Value Ratio Calculator Mortgage Broker Store

What Is The Loan To Value Ratio Ltv How To Easily Calculate It Fast

What Is The Loan To Value Ratio Ltv How To Easily Calculate It Fast

Maximum Loan To Value Ratio Overview What Is A Good Ratio

The Household Debt Ratio Is An Unsuitable Risk Measure There Are Much Better Ones Lars E O Svensson

What Is Ltv How To Calculate Ltv Loan To Value Ratio

Loan To Value Ratio What It Is And Why It Matters Forbes Advisor

What Is Ltv Loan To Value Ratio In Home Loan Abc Of Money

What Is The Loan To Value Ratio Ltv How To Easily Calculate It Fast

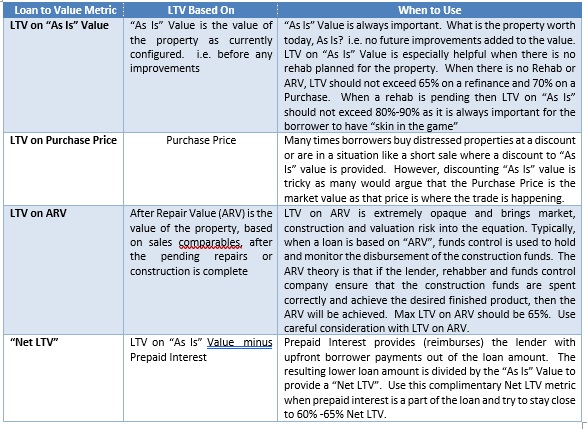

Loan To Value Ltv Ratios Which One To Use And When Crowdtrustdeed

What Is A Loan To Value Ratio

What Are Loan To Value Ratios

Non Recourse Loan How To Obtain A Non Recourse Loan With Examples

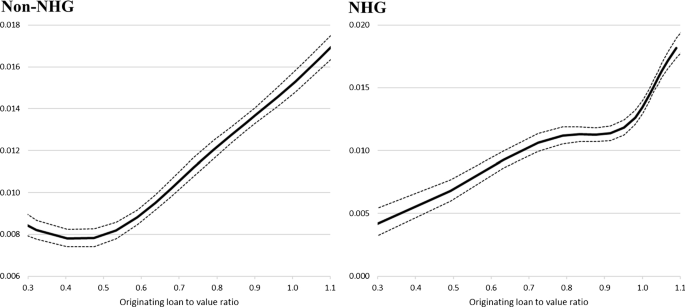

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink